By Lisandra Paraguassu and Anthony Boadle

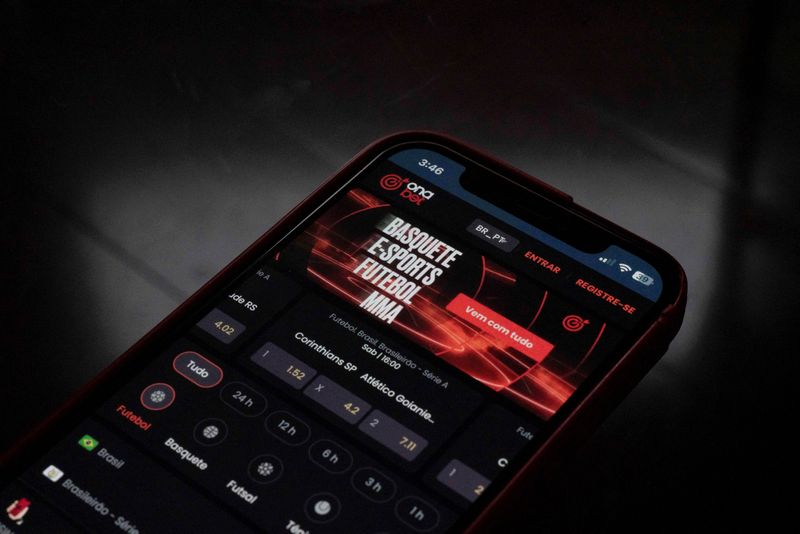

BRASILIA (Reuters) – Soccer-mad Brazilians have fallen hard for online sports betting, yielding a boom of interest from foreign gambling companies that may boost state coffers but also threatens to divert funds from consumer spending in other areas.

Latin America’s largest economy has seen lower-than-expected growth in consumer spending in the country in recent months, a weakness some banks and think tanks are blaming on gambling. Such a linkage would echo data seen in some U.S. states touched by online gambling fever.

Brazilian central bank governor-in-waiting Gabriel Galipolo has chimed in as well.

“Even major banks are discussing why the recent growth in income is not reflected in the growth of savings or consumption, and may be leaking into this type of activity, into gambling,” Galipolo said at a seminar last month, without elaborating.

Brazil’s online gambling boom underlines profound economic shifts that can result from the wider availability of betting and the tightrope for policymakers worldwide as they look to reap the gains in terms of tax receipts while avoiding the drawbacks.

The gambling industry disputes the impact betting has on consumption and maintains that the drop came with the COVID-19 pandemic that kept people at home for two years.

“The retail sector is using gambling as a scapegoat,” said lawyer Luiz Felipe Maia, who represents a dozen gambling companies in Brazil. He pointed out that one safeguard in last year’s law laying the rules for fixed-odds sports bets is a ban on the use of credit cards for betting.

Brazilians spent 68.2 billion reais ($12.2 billion) in the year ending in June on betting platforms abroad, according to an analysis by lender Itau Unibanco, based on central bank data. That would put it among the world’s top six sports betting markets.

‘STOPPED LIVING’

The Brazilian government expects to receive 3.4 billion reais in down payments for license requests alone, just before it starts to collect taxes on betting. Despite those gains, there are also signs that the gambling craze is already taking money out of the real economy.

Diego, a 38-year-old factory worker in Sao Paulo who became addicted to sports bets and then online slot machines, said his losses ate up his salary and left him in permanent debt.

“I made a lot of money gambling at first, but then I stopped winning. I couldn’t pay my credit card, basic household bills, my rent,” he said, asking that his surname be withheld.

“I practically stopped living.”

Concern over Brazil’s addiction to sports betting led the government to adopt measures to restrict advertising hours and exposure to children. Consumer surveys indicate Brazilians are betting with funds they would normally spend on other goods and services.

Family spending on gambling jumped to 1.9% of their income by this year, double the portion in 2018, according to a recent Santander (BME:SAN) bank report. At the same time, households cut to 57% of their income outlays for food, clothing, electronics, beauty products and medicine, from a peak of 63% in 2021.

Another study by PwC’s consultancy Strategy&, based on a national survey of household income, shows that betting took up 38% of entertainment budgets in 2023, up from 10% in 2018.

Lower income groups already struggling to pay their credit card debt comprise 79% of bettors, according to consumer research center Locomotiva Institute.

“This money would normally go to the neighborhood shopkeeper and boost the economy from the bottom up,” said Renato Meirelles, head of the institute. “Now it is being eaten up by the bets instead of going into the real economy.”

INVESTOR RUSH

Online sports betting in Brazil began in 2018, but the government did not start regulating the activity until last year. This has forced multinational companies to have a base in the country, register and pay corporate taxes. The deadline to register was Aug. 20, and there was a rush to sign up.

Companies including MGM Resorts (NYSE:MGM) International, Betfair, owned by the Flutter Entertainment, Sweden’s Betsson AB and the largest U.S. casino-entertainment company Caesars (NASDAQ:CZR) Sportsbook were among those placing 113 registration requests, said the Finance Ministry’s secretary in charge of overseeing betting, Regis (NASDAQ:RGS) Dudena.

“Brazil is practically a greenfield market in a country of 200 million people who love sports and like betting. That is why there is so much investor interest,” said Andre Gelfi, general manager of Betsson Brazil.

Brazil isn’t the only major world economy to see a tug of war between the positive and negative effects of online gambling.

A study led by Brett Hollenbeck, a professor at the University of California, Los Angeles, shows U.S. states that legalized online bets after the Supreme Court overturned a ban in 2018, saw an negative impact on average credit scores.

After three to four years of legalization, the likelihood of families filing for bankruptcy increased 25% to 30%, it said.

Another study by economists from the Universities of Kansas, Northwestern (NASDAQ:NWE) and Brigham Young, entitled “Gambling away stability,” said from each dollar spent on betting, financially constrained families take the equivalent of $2 from their savings and increased credit card debt by 8%.